Added VA Benefits

Persistence, Dedication To Client Pays Off After 4 long years, Lee and attorney Jim Swain’s continued pressure on the VA finally paid off for a 91 ...

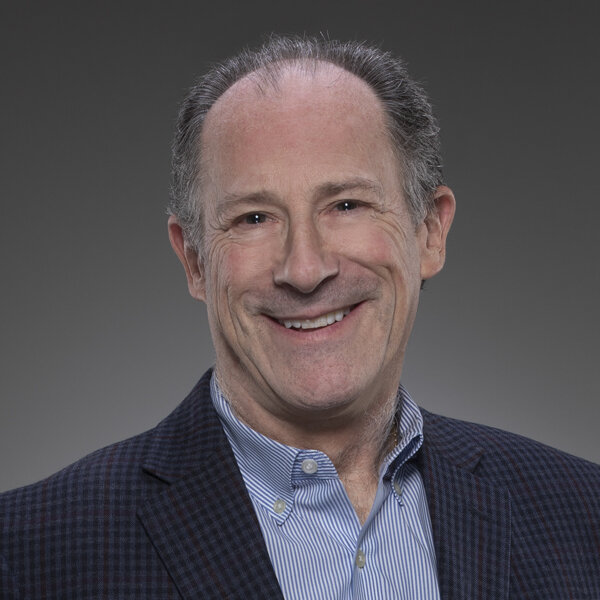

Benefit from a senior, experienced professional working with & reporting directly to you. Enjoy personal access to the decisions and rationale affecting your future. With 35 years fiduciary investment and family experience, you benefit from the concern, awareness and problem–solving capabilities unavailable elsewhere. Investing for Life supports your family with personal and direct attention no matter what life brings.

Meeting whenever and wherever you need, we provide customized analytical reports to clarify progress and awareness. Making you confident in our Investing For Life strategies is our goal. This means tailoring the strategy and reporting, from simple and concise to extensive and detailed. You are encouraged to discuss any problems affecting your life so we can help you navigate through them with financial success. We freely offer all of our contacts and resources to improve your ability to manage and prosper without concern. Start Investing For Life today.

Whether you need personal financial advice or advice for a family member, we are dedicated to providing you with help that goes far beyond your investment portfolio. Contact us to schedule a time to meet to discuss your financial goals, asset management strategies and plans for income enhancement.

The Chartered Financial Analyst® (CFA) credential has become the most respected and recognized investment designation in the world. Lee is one of the few experienced CFAs to deal directly with clients, solving their unique problems, knowing them on a deep, personal level.

American Wealth Management is a local investment advisor association with over $300 million in managed assets. AWM provides back-up advisory services to your CFA, regulatory oversight and supervision.

Many people confuse what we do with what a broker does. In general, a broker is an intermediary who facilitates securities transactions and as such, gets paid a commission for each transaction he or she initiates. While many brokers provide a wide range of valuable services for their clients, their business model is essentially a sales-driven model.

Conversely, we manage investment portfolios with the primary goal of delivering superior investment performance, and more attentive service to any client need. Our business model is essentially one of stewardship; we seek to help clients reach wealth and retirement goals and we benefit if our clients do.

Our firm is independently owned and operated which we believe gives us the best chance to make the best possible decisions for our clients. We have no outside owners which may have interests that could conflict with the interests of our clients. Some industry experts consider independence to be a competitive advantage.

Some firms rely on short term focus, often trying to guess the “unguessable”. We cannot afford to be so cavalier with clients’ life savings. Explosive, alluring short term trends that tease investors into disasters.

We use enduring economic laws, accepted by science and academics, as fuel to drive wealth and value growth. Always avoid speculative, short term trends that can be misleading, vacuous, costly, and fundamentally unpredictable.

Our research focuses on long-term insights, not on short-term noise and trends. We know that over longer periods of time, asset returns migrate toward their intrinsic equilibrium norms. During shorter, interim periods, however, the numerous and diverse effects on trading activity make it excessively difficult to for individuals to see through the veil of confusion and doubt.

Mutual funds can offer many advantages to many people. Most funds tend to be very accessible in that they have low minimum initial investment requirements. Many are widely advertised and distributed so it is easy to find information about them. There is also an enormous variety of mutual funds that can suit virtually every investment need.

The risk that many mutual funds pose to individual investors is that they may not offer a very good value. Many fund companies are much more oriented to the marketing and distribution part of the business and much less focused on delivering superior investment strategies, and thus, performance. In fact, research has shown that inflows and outflows to a mutual fund can substantially impair the ability of the fund manager to outperform regardless of his or her ability. These and other issues help explain why so few mutual funds outperform their benchmarks. And why selecting funds on the basis of track record can lead to disaster.

Clients have access to the investment decision maker, his thoughts and rationales, not a mere representative. We do not have allegiances to any particular fund or investment strategy. Client portfolios are tailored to meet their individual financial goals.

We minimize or eliminate all but the most essential costs. Using low turnover (lowers unseen transaction costs and taxes), rock bottom fees (index funds), so there is no additional charge for us and a fund management company. Where fees are necessary, they are structured to insure that they are covered by superior results.

We also specialize in making sure our veteran clients receive the full benefits they deserve. In many cases this means thousands of extra dollars each month.

While there is no minimum size, there is a $3,000 minimum annual fee. This tends to work best with accounts $300,000 and above. We believe that is the optimal balance between being able to offer our services to as many investors as possible, while still providing quality individual attention.